Portfolio Dashboards

We have proprietary developed monitoring tools which integrate with our fund administrator to give us daily insights into the portfolios. Here are a few examples:

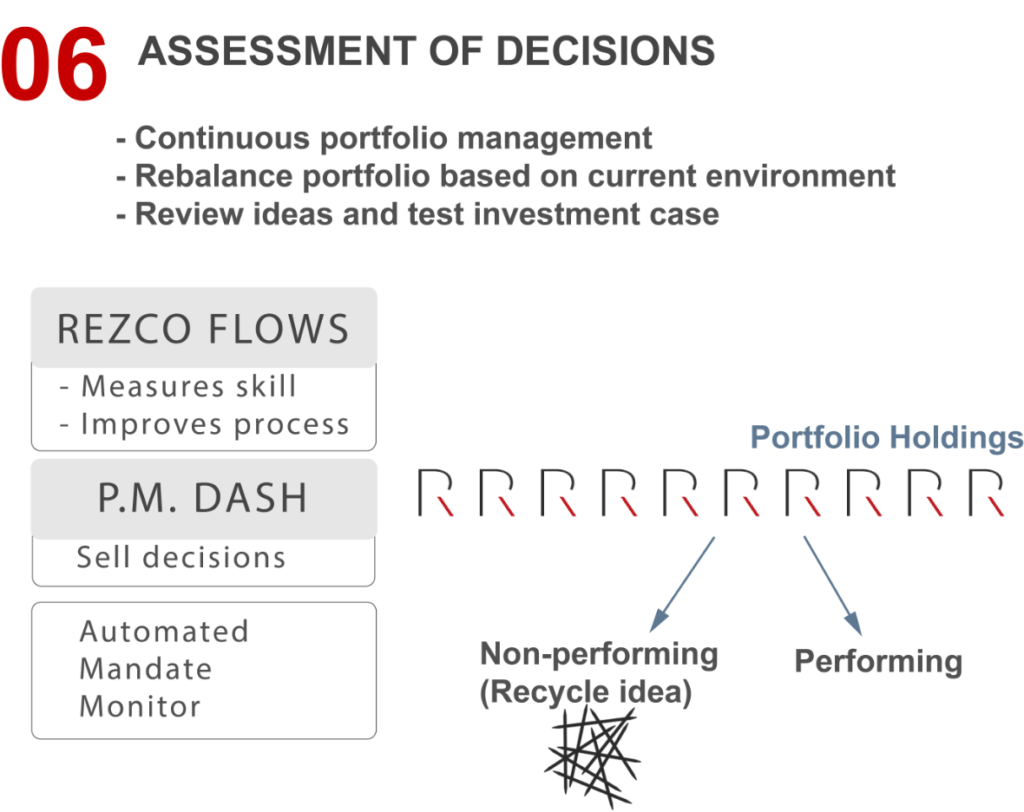

Sell Discipline

We apply a consistent and unemotional view to both buy and sell decisions.

Given that we are an owner-managed business, there is no career risk affecting our investment decisions. Therefore, we are able to recognise mistakes early on and admit that we were wrong. This is part of being an active manager.

We sell our investments when we no longer see value in the position. This could be as a result of the following :

- The company has reached a value where we don’t see further growth opportunities (harvest).

- We are concerned about internal management issues i.e. key-man risk.

- The company’s competitive advantage and sustainability has been eroded.

- The company’s quality of earnings is being eroded.

- We would also sell a company as a result of industry changes that will have a negative impact.

- We would sell where the industry and company are experiencing headwinds.