The following outline a few of principles behind our investment philosophy:

- Risk-Adjusted Returns is our investment objective (Lower Volatility and Low Drawdown)

- Style: GARP (Growth at a Reasonable Price)

- Benchmark Agnostic

- ESG core to philosophy

- Active Asset Allocation adds value

- Use Technology to help find opportunities

- Small caps <5% in small caps (R2bn CISCA and Reg 28)

- Superforecaster mindset (TRACK, LEARN from them, REWARD)

These principles are the key reasons why we believe that we will continue to outperform.

Managing Risk

It is fundamental to our approach that risks must be well managed and that capital must be protected. Our objective is to preserve capital during times of market weakness by managing multiple risks and to outperform the overall index during periods that are positive for equities. Our strategy is to acquire interests in well-managed companies that we believe will have sustainable growth, at a reasonable price.

The Rezco investment philosophy combines the best aspects of value investing with superior sustainable earnings growth, primary trend analysis and measured market timing. We seek companies with attractive price earnings ratios relative to their long-term growth prospects. Investments are intended for the long term, but we recognise the changes in circumstances that can lead to altered risk levels, necessitating earlier adjustments to the portfolios.

Our funds tend to be more concentrated than most. We make significant investments in shares that meet our highly selective criteria and aim, for example, for our local shares to have a minimum of 3% of the portfolio in any one share.

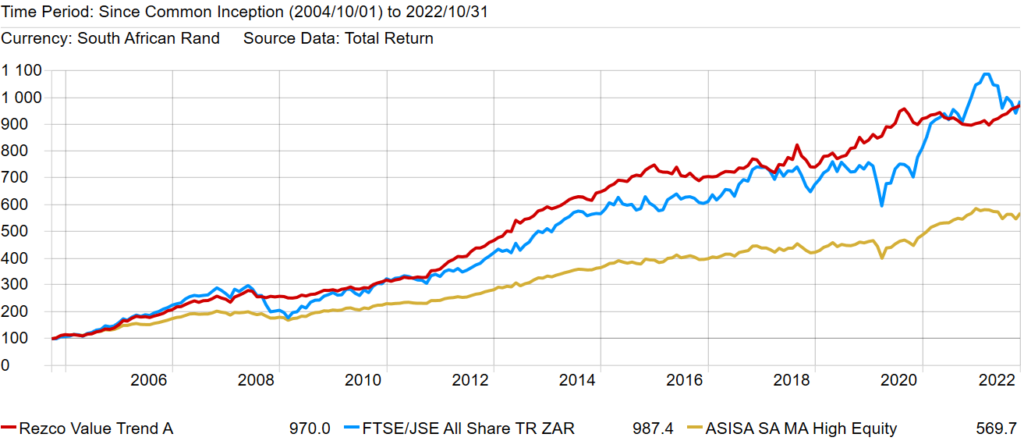

For example, this chart illustrates how our Rezco Value Trend Fund managed the risks and preserved capital during 2008’s Global Financial Crisis, and more recently during the “Corona Financial Crisis” (CFC) (Source: Morningstar):

The Zone

We look for stocks in our Zone, which is illustrated by this diagram:

Stock Selection

Our selection philosophy is one of investment only in assets in which we have high conviction of market outperformance. Our investment conviction will be based on the quality of the asset, its growth relative to its peers, the relative value at which it is currently available and the macroeconomic environment in which it currently trades and/or operates. We are in no way benchmark or index tied and we will, therefore, invest only in the best assets within any given asset class, given that the asset class is of interest to us within the current investment environment.

For more details on how we determine our stock weightings, please visit our Portfolio Construction page, which is step 4 of our Investment Process.

Asset Allocation

Our asset allocation philosophy is to position ourselves in the asset classes that will best help us to protect capital and create wealth within any given market condition. We are in no way tracking an index or benchmark, and are entirely flexible in our asset allocation. We will only expose ourselves to the asset classes that show the best growth potential at the best possible value at any given time.

For more details on how we determine our asset allocations, please visit our Portfolio Construction page, which is step 4 of our Investment Process.

Investment Themes

Our investment thinking is often theme-driven in that a theme can often come as a result of specific tailwinds or headwinds within an economy, industry or sector. These tailwinds or headwinds can often be the driving force behind outperformance or underperformance and, for this reason, they are seriously considered when making investment decisions.

For more details on the factors we consider when developing investment themes, please visit our Portfolio Construction page, which is step 4 of our Investment Process.

Diversification

We strongly believe in diversification, and that this is the only “free lunch” in investing. Although our investment approach and idea generation methods do not revolve specifically around diversification, much thought and consideration is taken to not overexpose ourselves to any particular sector, theme, currency or geographical region but, instead, to have a robust and diverse portfolio of holdings that will provide us with downside protection as well as the potential to benefit from a variety of sources of value and growth.

High Conviction

Our investment philosophy is one of investing only in assets in which we have high conviction. We therefore expect to get our investment decisions right at least 80% of the time.

Low / No Exposure to Small Caps

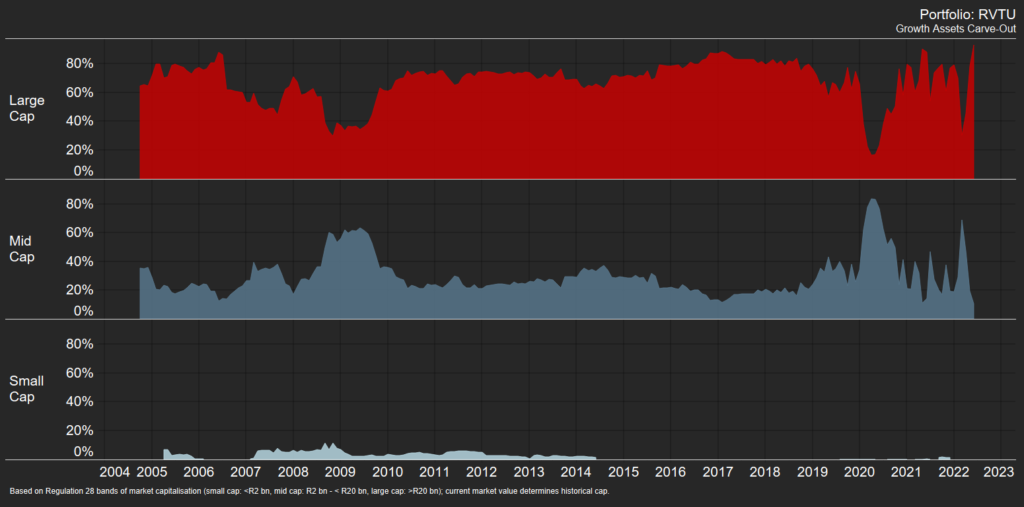

We actively have little / no exposure to Small Cap stocks. This chart, for example, outlines that the historical exposure to Small Caps for our Rezco Value Trend Fund has averaged less than 3% (Source: JTC Group):